The consumer price index is the New York Mets of the economy—always disappointing you come September.

Yesterday’s report showed that consumer prices continued their upward march last month. The hotter-than-forecast data indicates that the Fed’s aggressive interest rate hikes have not led to lower inflation just yet, and that even when the rate hikes do kick in, it’s going to be a long slog back to normal inflation levels.

The headline number from the report was the 0.6% monthly increase in core CPI, which is considered a more accurate picture of inflation because it doesn’t include volatile food and gas prices. That 0.6% bump is worryingly high, and matches the same jump from August. The annual core CPI figure of 6.6% was the biggest jump in 40 years.

You can’t blame this on the supply chain

Economic officials had thought that inflation would ease when those epic supply chain bottlenecks let up. But now you can actually find a parking spot at the LA ports…and inflation is still rampant. It shows that the inflation virus has switched hosts from goods → services, infecting a broad array of economic sectors with soaring prices.

- Healthcare, education, auto repair, and other services all posted price increases last month.

- Airfares have spiked 42.9% in the last year.

- Shelter costs, the biggest component of the services sector, have jumped the most on record over the past year (6.7%).

How does this end?

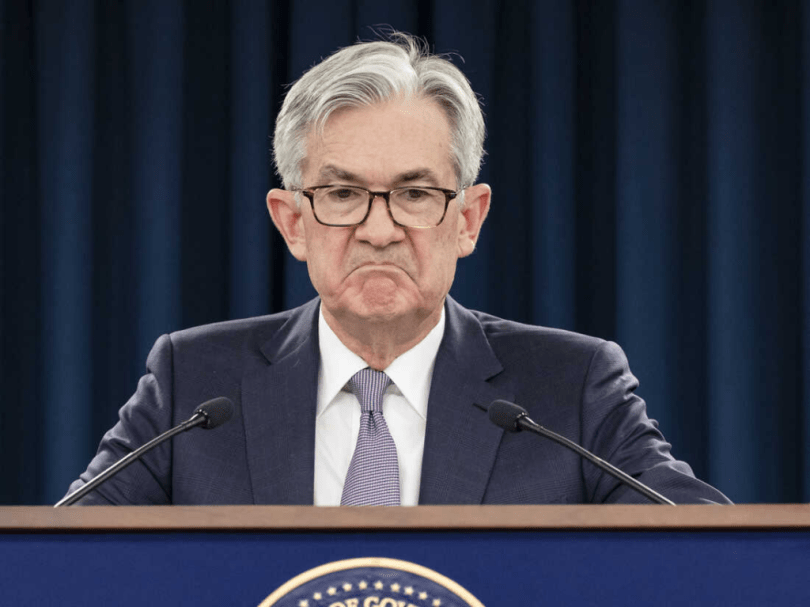

Slowly and painfully, probably. Because Fed Chair Jerome Powell can’t just launch a projectile to knock inflation off its course, or simply ban inflation like they do in Belarus, he has to keep raising interest rates until economic growth slows down and prices cool off. That could take a long time, because services inflation is harder to tame than goods inflation.

Looking ahead…this CPI report, paired with the strong jobs numbers for September, basically guarantees that the Fed will hike rates by 75 basis points for the fourth straight time at its next meeting.