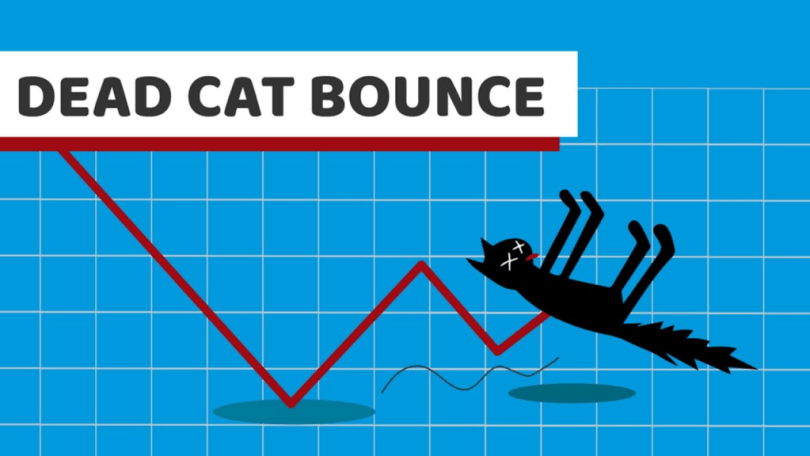

A bear market rally, also known as a dead cat bounce or a sucker rally, refers to a sharp, short-term rebound in share prices amid a longer-term bear market decline.

Bear market rallies are treacherous for investors who mistakenly come to believe they mark the end of an extended downturn. As the primary bearish trend reasserts itself, the disappointment of those who bought during a bear market rally helps to drive prices to new lows.

U.S. equity markets surged yesterday, bouncing back from losses earlier this week, boosted by tech and growth stocks. The three major averages all gained, with the tech-heavy Nasdaq rising 2.7%, the S&P 500 gaining over 1.8%, and the Dow finishing 1.3% higher.

Heading into the end of the first trading week of June, the Dow and S&P 500 are relatively flat for the week, while the Nasdaq is up over 1%. Last week, all three gained over 6%. However, according to Morgan Stanley strategists, broader negative trends in corporate earnings and economic indicators could ultimately limit the scope of recent rallies, as investors grapple with the possibility of a recession amid Federal Reserve moves tightening policy to combat inflation.

In a note this week, Morgan Stanley Equity Strategist Michael Wilson explained that while he believed the S&P 500 could rebound further, the relief rally would likely remain a bear market rally. Wilson predicts that by mid-August, the S&P 500 could fall to 3,400 points, an over 18% decline from yesterday’s close.

To further confirm this, today’s opening saw a 2% decline in Nasdaq, 1% decline for S&P 500.